Facts About Amur Capital Management Corporation Uncovered

Wiki Article

Things about Amur Capital Management Corporation

Table of ContentsNot known Incorrect Statements About Amur Capital Management Corporation Get This Report about Amur Capital Management CorporationNot known Facts About Amur Capital Management CorporationAmur Capital Management Corporation Can Be Fun For AnyoneThe 4-Minute Rule for Amur Capital Management CorporationAbout Amur Capital Management CorporationThe Basic Principles Of Amur Capital Management Corporation

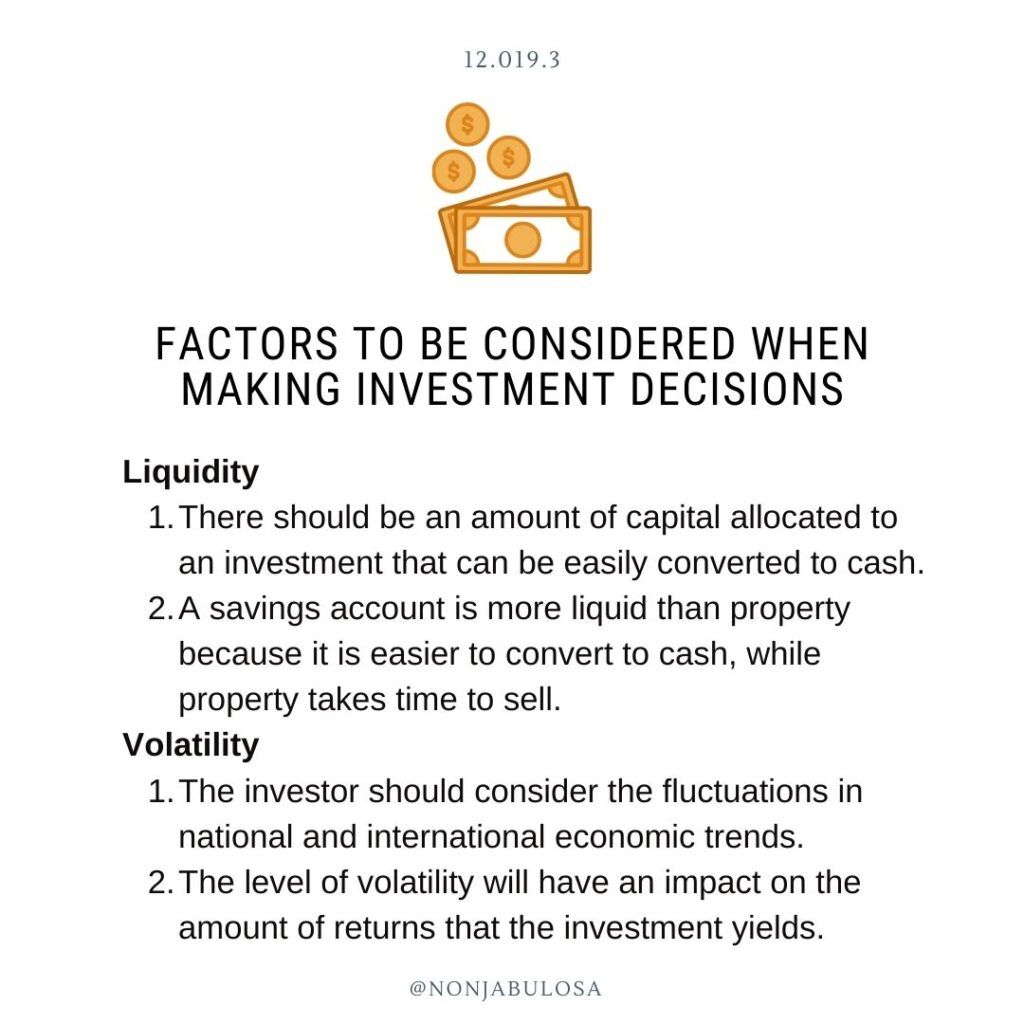

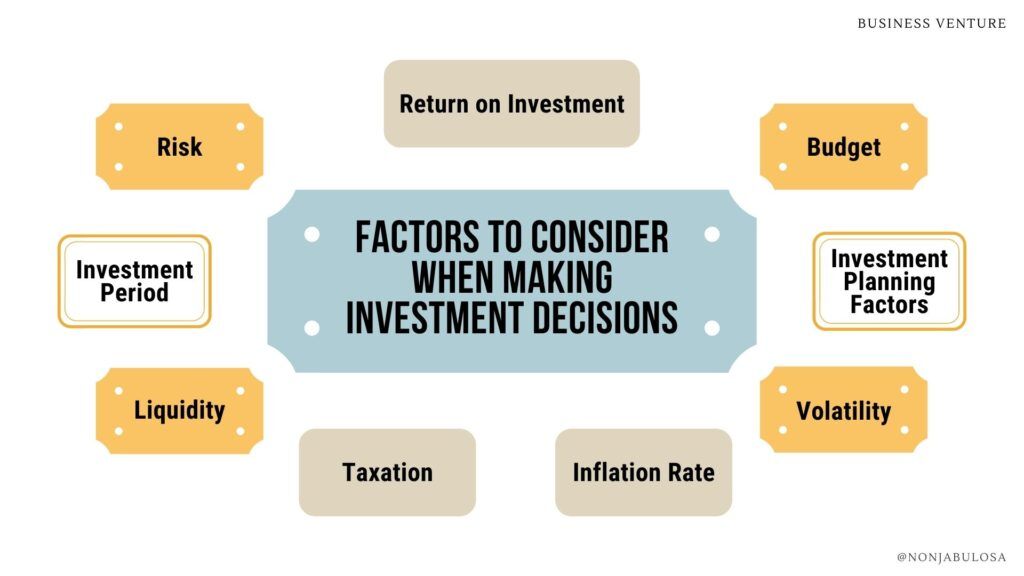

That single sentence can apply to the job of selecting your investments. Right here are some fundamental ideas any type of financier ought to comprehend if they desire to boost the effectiveness of their financial investment choice.Offer your money time to expand and worsen. Determine your danger resistance, after that select the kinds of investments that match it. Learn the 5 crucial facts of stock-picking: returns, P/E ratio, beta, EPS, and historic returns. The Pareto Concept is a practical idea to bear in mind when beginning a task that includes a large amount of info, such as the topic "exactly how to select your financial investments." In numerous elements of life and understanding, 80% of the results come from 20% of the effort.

The 10-Minute Rule for Amur Capital Management Corporation

You need to devote to an amount of time during which you will certainly leave those investments unblemished. A practical rate of return can be expected only with a lasting perspective. When investments have a long period of time to value, they're more probable to weather the inevitable ups and downs of the equities market.Another essential reason to leave your investments untouched for numerous years is to take benefit of intensifying. When you start gaining cash on the money your financial investments have actually currently gained, you're experiencing compound growth.

Not known Facts About Amur Capital Management Corporation

They get the advantage of intensifying growth over a longer time period. Asset allotment suggests placing your investment funding into a number of kinds of investments, each representing a percentage of the whole. Assigning possessions into various classes that are not very associated in their cost action can be a highly efficient method of expanding threat.If you desire to diversify your profile even more, you may expand beyond those two classes and consist of genuine estate financial investment trust funds (REITs), products, foreign exchange, or international supplies. To know the appropriate appropriation technique for you, you need to understand your resistance for danger. If momentary losses maintain you awake during the night, focus on lower-risk options like bonds (accredited investor).

The 7-Second Trick For Amur Capital Management Corporation

Nobel Champion economic expert Harry Markowitz described this benefit as "the only free lunch in finance - https://sitereport.netcraft.com/?url=https://amurcapital.ca. mortgage investment." You will certainly gain more if you diversify your profile. Below's an example of what Markowitz indicated: A financial investment of $100 in the S&P 500 in 1970 would certainly have expanded to $7,771 by the close of 2013

Currently, visualize you embrace both methods. If you had invested $50 in the S&P 500 and the other $50 in the S&P GSCI, your overall financial investment would certainly have grown to $9,457 over the exact same period. This implies your return would certainly have gone beyond the S&P 500-only profile by 20% and be virtually dual that of the S&P GSCI performance.

The 10-Minute Rule for Amur Capital Management Corporation

Whatever else takes highly specialized expertise. If you're a professional on antique Chinese porcelains, go all out. If you're not, you're far better off sticking with the basics. If most imp source capitalists can reach their objectives with a combination of stocks and bonds, after that the ultimate question is, just how much of each course should they pick? Allow background be an overview.

The truth is, the total return on stocks traditionally has actually been much greater than for all various other property classes. In his book Supplies for the Long term, author Jeremy Siegel makes a powerful instance for developing a portfolio being composed primarily of supplies. His reasoning: "Over the 210 years I have actually analyzed stock returns, the actual return on a broadly diversified profile of stocks has balanced 6. investing for beginners in canada.6% per year," Siegel claims

Facts About Amur Capital Management Corporation Revealed

"At the end of 2012, the return on nominal bonds had to do with 2%," Siegel notes. "The only method that bonds might generate a 7.8% actual return is if the customer price index fell by almost 6% annually over the next 30 years. Yet a deflation of this size has never been maintained by any type of nation in world background." Whatever mix you choose, make sure that you choose.Case in factor: At a price of 3% rising cost of living annually, $100,000 will be worth just $40,000 in thirty years. Your age is as relevant as your character. As you get closer to retirement, you should take fewer threats that might jeopardize your account balance just when you need it.

What Does Amur Capital Management Corporation Do?

In keeping with the Pareto Principle, we'll think about the 5 crucial elements. They are rewards, P/E ratio, historical return, beta and earnings per share (EPS). Dividends are a powerful method to boost your earnings. The frequency and amount of the reward are subject to the business's discretion and they are mainly driven by the firm's financial efficiency.

Report this wiki page